Has your tax investigation gone past its sell-by date and gone stale?

We can all look forward to our favourite treat only to be disappointed that is has gone stale. Imagine how HMRC must feel when they are told a tax investigation has gone stale and the tax is no longer due.

Well, both can happen and both do happen.

Do you have anything to disclose?

A simple question but if it is answered the wrong way, it can have a devastating effect. “Do you have anything to disclose?” is a question that is regularly asked by HM Revenue & Customs (HMRC) at the outset of an investigation

The “too difficult” category

Most people have consciously moved a particular task into the “too difficult” category. It is worrying how many times a “too difficult” task results in some form of UK tax irregularity. Examples can ultimately include the lack of an up to date Tax Return for an individual, partnership, limited liability partnership or company. But that is not how it all starts.

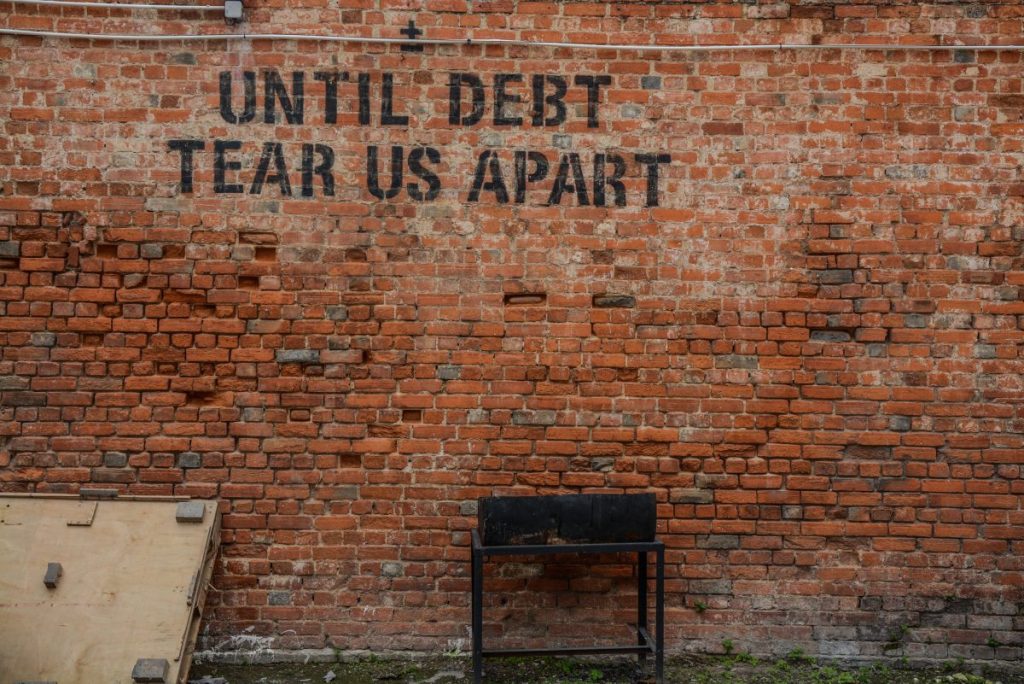

HMRC have their preferential debt status returned to them

As part of Under the Finance Act 2020, the Treasury drafted the Insolvency Act 1986 (HMRC Debts: Priority on Insolvency) Regulations 2020 (the Regulations). In short, HMRC have their preferential debt status returned to them.

What HMRC giveth in 2020, will HMRC taketh away in 2021?

As part of the UK government’s support to the economy in 2020 in response to the pandemic, exceptionally HMRC have been making payments to taxpayers rather than collecting tax payments from taxpayers. Clearly, this cannot continue indefinitely.