Accidental tax fraud

There are many definitions of tax fraud – the working definition I use is “the intention to deceive”. HMRC have their own view on life and as such, HMRC does not accept that a taxpayer can commit accidental tax fraud. Moreover, HMRC consider any form of tax fraud to be deliberate behaviour.

Loan Charge – what is a loan?

HMRC continue to pursue taxpayers who have received loans back from either in lieu of earnings of typically a contractor or back from an Employee Benefit Trust (EBT). The Loan Charge was effective from 30 September 2020 by which time HMRC were to be notified of all such loans and tax paid on them under the Disguised Remuneration rules. But for some, the issue has become what is a loan?

HMRC issue latest round of “nudge letters”

Periodically HMRC issue “nudge letters” to taxpayers as a means of persuading them to reconsider their past UK tax compliance. The content of such letters is based on information already received by HMRC form any of its numerous sources including under the Common Reporting Standard (CRS).

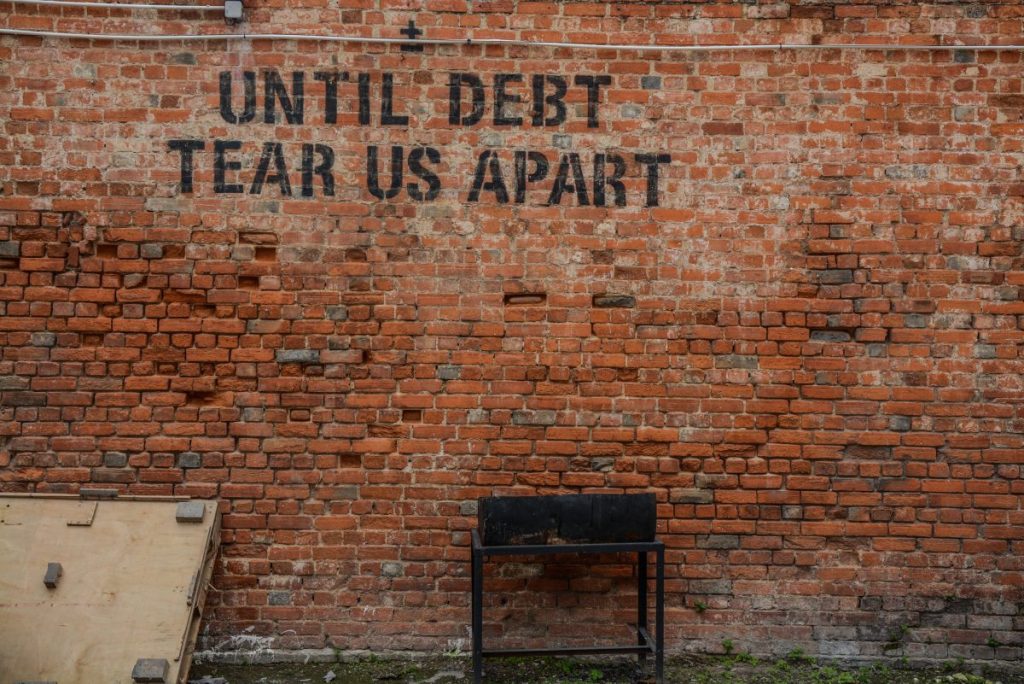

HMRC have their preferential debt status returned to them

As part of Under the Finance Act 2020, the Treasury drafted the Insolvency Act 1986 (HMRC Debts: Priority on Insolvency) Regulations 2020 (the Regulations). In short, HMRC have their preferential debt status returned to them.

What HMRC giveth in 2020, will HMRC taketh away in 2021?

As part of the UK government’s support to the economy in 2020 in response to the pandemic, exceptionally HMRC have been making payments to taxpayers rather than collecting tax payments from taxpayers. Clearly, this cannot continue indefinitely.